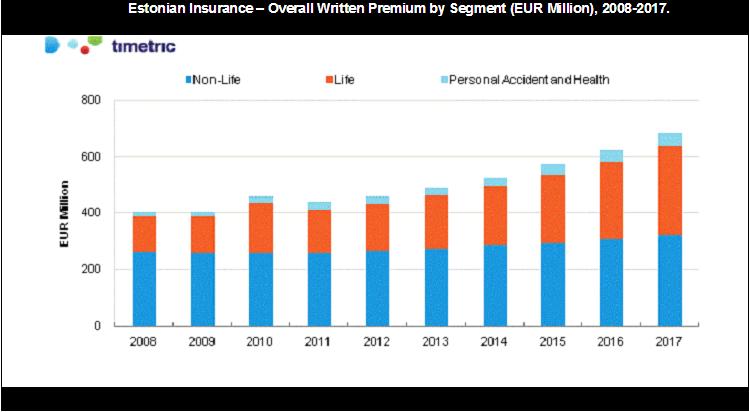

The Estonian life insurance segment grew at a CAGR of 7.6% between 2008 and 2012, driven by an aging population and demand for investment linked products. The aging population drove consumer attention towards post retirement savings. This is expected to remain the growth driver for life insurance over the next 5 years, during which time the segment is expected to expand at a CAGR of 13.6%.

Life insurance in Estonia is predominantly distributed through the e-commerce and direct marketing channels. In terms of written premium for new business in 2012, e-commerce accounted for the largest market share of 65.8%, followed by direct marketing with 16.2%. The value of the Estonian life insurance segment has grown continuously over the last 5 years and is expected to reach a projected value of EUR313.2 million (US$436.2 million) in 2017, as a result of the growing economy, aging population and growing consumer awareness of the importance of life insurance.

Complete Report Copy@ http://www.rnrmarketresearch.com/life-insurance-in-estonia-key-trends-and-opportunities-to-2017-market-report.html

The European debt crisis had an adverse effect on demand for investment linked life insurance products in Estonia. This, in turn, led to a decline in the country’s life insurance segment. However, following a recovery in the economy, demand for investment linked life insurance products improved in 2012, resulting in the overall life insurance segment registering a growth rate of 8.0%. The Estonian GDP at current prices is expected to increase at an average rate of 6% over the next 5 years. Such growth in the GDP is expected to drive Estonian consumers towards investment linked life insurance products.

The aging population of Estonia is a major driving force for life insurance products in the country. The increase in life expectancy from 75.4 years in 2010 to 76.5 years in 2011 encouraged more people to take out guaranteed return life insurance products such as pensions.

Order / Buy a Report Copy @ http://www.rnrmarketresearch.com/contacts/purchase?rname=104927

Target audience

– Insurance companies

– Suppliers to insurance companies.

– Contractor research organizations

– Trade body, academia or other industry observers

– Companies involved at any stage in the manufacturing, procurement and marketing process

– Marketing and advertising agencies

Reasons to buy

– Realize the growth potential and attractiveness in the Estonian Life Insurance industry through means of Timetric’s analysis and outlook’s.

– Gain a better understanding of the industry by reviewing analysis of the key industry trends and drivers.

– Plan for the future by understanding the current business environment and country risk.

Explore More Reports @ http://www.rnrmarketresearch.com/reports/business-financial-services/financial-services/insurance-financial-services/lifeinsurance

Table of Content

8 Reinsurance Growth Dynamics and Challenges

8.1 Reinsurance Segment Size, 2008-2017

8.2 Reinsurance Segment Size by Insurance Segment, 2008-2017

9 Competitive Landscape and Strategic Insights

9.1 Overview

9.2 Leading Companies in the Estonian Life Insurance Segment

9.3 Swedbank Life Insurance SE – Company Overview

9.3.1 Swedbank Life Insurance SE – key facts

9.3.2 Swedbank Life Insurance SE – key financials

9.4 Compensa Life Vienna Insurance Group SE – Company Overview

9.4.1 Compensa Life Vienna Insurance Group SE – key facts

9.4.2 Compensa Life Vienna Insurance Group SE – key financials

9.5 SEB Elu- ja Pensionikindlustus – Company Overview

9.5.1 SEB Elu- ja Pensionikindlustus – key facts

9.5.2 SEB Elu- ja Pensionikindlustus – key financials

9.6 Mandatum Life Insurance Baltic SE – Company Overview

9.6.1 Mandatum Life Insurance Baltic SE – key facts

9.6.2 Mandatum Life Insurance Baltic SE – key financials

10 Business Environment and Country Risk

10.1 Business Confidence

10.1.1 Market capitalization trend – Tallinn Stock Exchange, Estonia

10.2 Economic Performance

10.2.1 GDP at constant prices (US$)

10.2.2 GDP per capita at constant prices (US$)

10.2.3 GDP at current prices (US$)

10.2.4 GDP per capita at current prices (US$)

10.2.5 GDP by key segments

10.2.6 Agriculture, hunting, forestry, fishing net output at current prices (EUR)

10.2.7 Agriculture, hunting, forestry, fishing net output at current prices (US$)

10.2.8 Agriculture, hunting, forestry, fishing net output at current prices as a percentage of GDP

10.2.9 Manufacturing net output at current prices (EUR)

10.2.10 Manufacturing net output at current prices (US$)

10.2.11 Manufacturing net output at current prices as a percentage of GDP

10.2.12 Mining, manufacturing and utilities net output at current prices (EUR)

10.2.13 Mining, manufacturing and utilities at current prices (US$)

10.2.14 Mining, manufacturing and utilities at current prices as a percentage of GDP

10.2.15 Construction net output at current prices (EUR)

10.2.16 Construction net output at current prices (US$)

10.2.17 Construction net output at current prices as a percentage of GDP

10.2.18 Inflation rate

10.2.19 Exports as a percentage of GDP

10.2.20 Imports as a percentage of GDP

10.2.21 Exports growth

10.2.22 Imports growth

10.2.23 Annual average exchange rate EUR-US$

10.3 Infrastructure Quality and Availability

10.3.1 Commercial vehicles exports total value

10.3.2 Commercial vehicles imports total value

10.3.3 Automotive exports total value

10.3.4 Automotive imports total value

10.3.5 Total internet subscribers

10.4 Labor Force

10.4.1 Labor force

10.4.2 Unemployment rate

10.5 Demographics

10.5.1 Gross national disposable income (US$)

10.5.2 Total population

10.5.3 Urban and rural population

10.5.4 Age distribution of the total population